Always Be in the Know of Your Network Health + Compliance

IT Complete’s Audit and Compliance Solutions enhance network visibility for IT professionals by automating the discovery of hard-to-find issues. They give you the power to respond immediately, improve your security and prove compliance.

Explore Kaseya's Audit & Compliance Solutions

IT Complete’s Audit and Compliance tools inform you of what’s on your network, identify vulnerabilities and monitor for suspicious activity. They help ensure your IT infrastructure is compliant with the latest data protection and security standards.

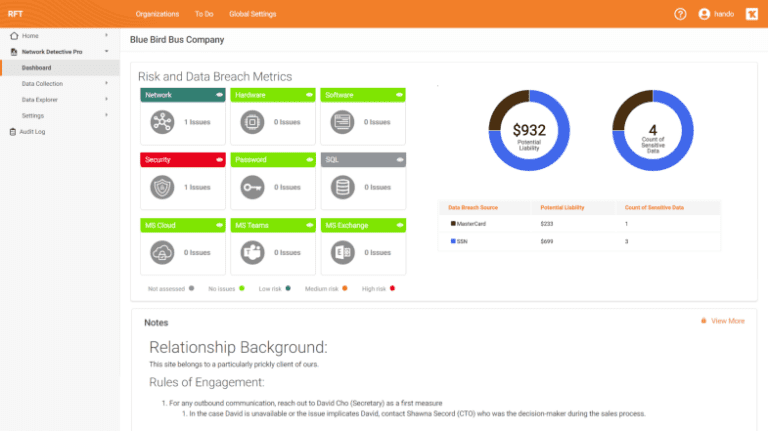

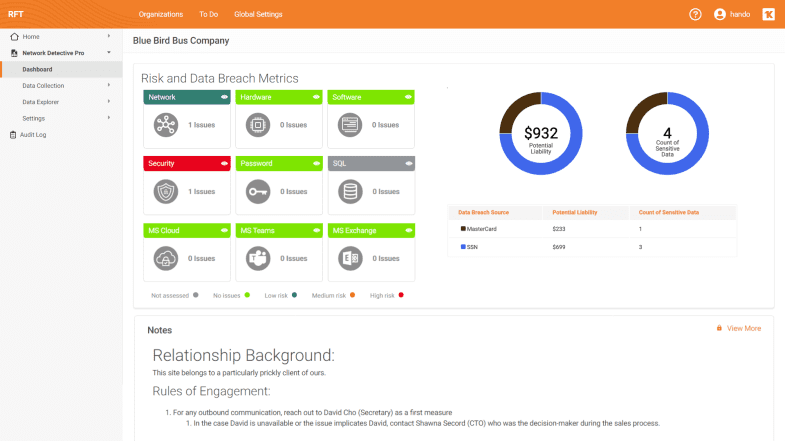

Network Detective Pro

Network Detective Pro automatically collects data from every device on your network, then identifies and remediates issues based on objective risk scores.

Discover Network Detective

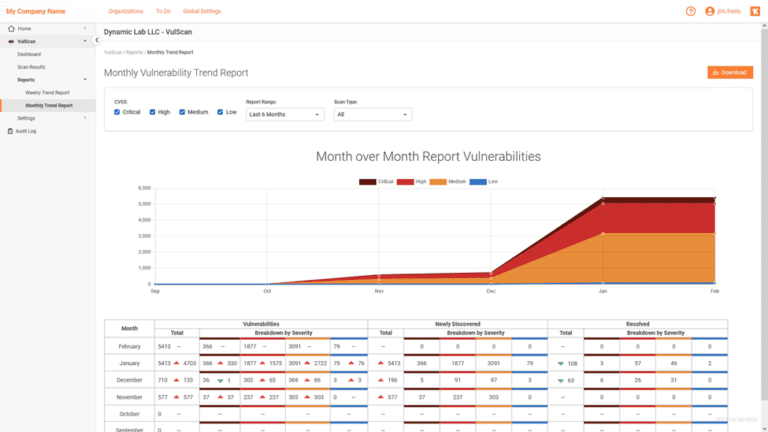

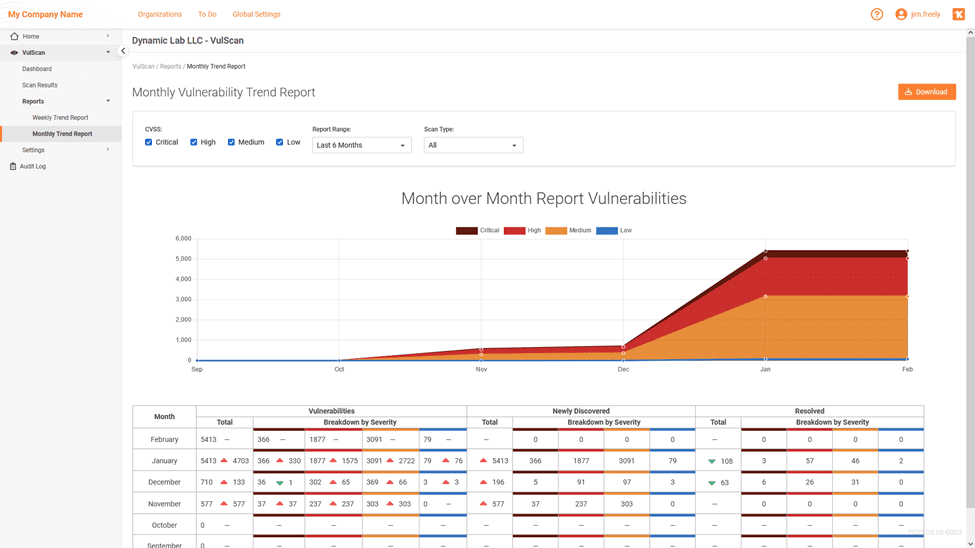

VulScan

VulScan identifies IT vulnerabilities in your network by automatically scanning and prioritizing remediations, so you can resolve issues rapidly.

Discover VulScan

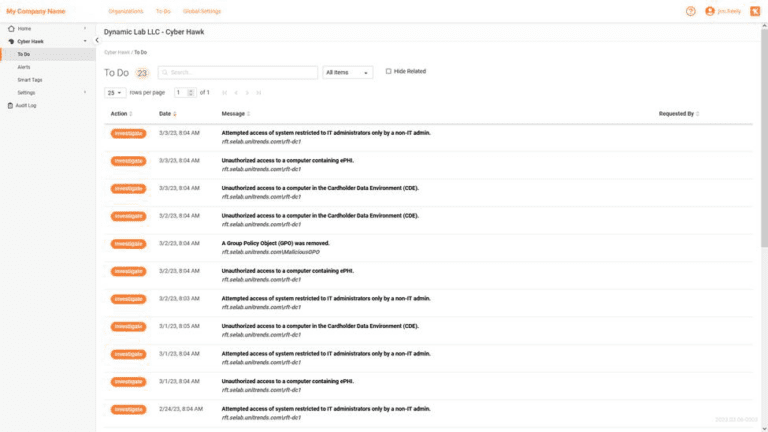

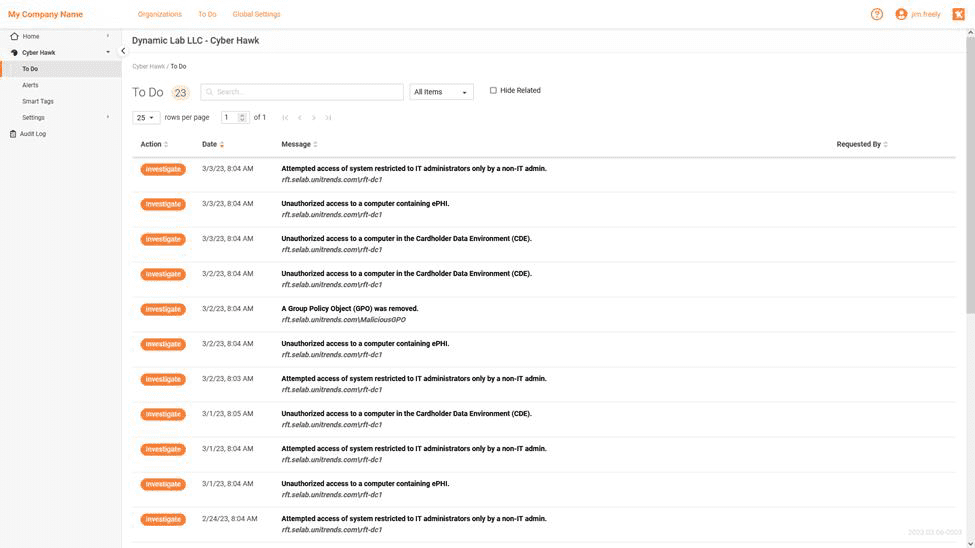

Cyber Hawk

Cyber Hawk detects and alerts on suspicious changes, misconfigurations and activities across your network that create vulnerabilities in your systems.

Discover Cyber Hawk

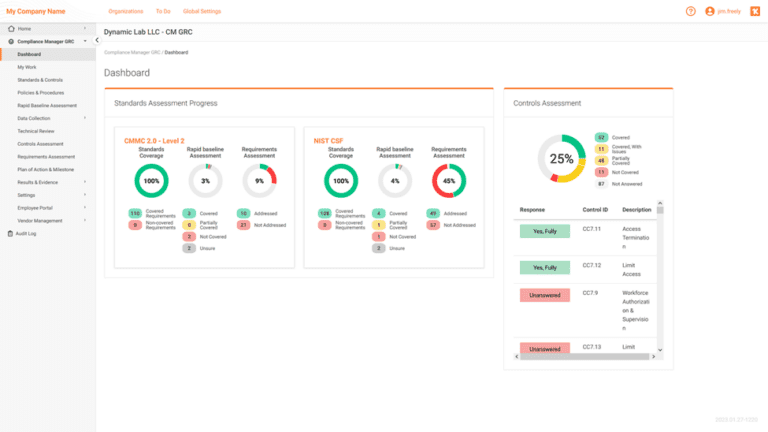

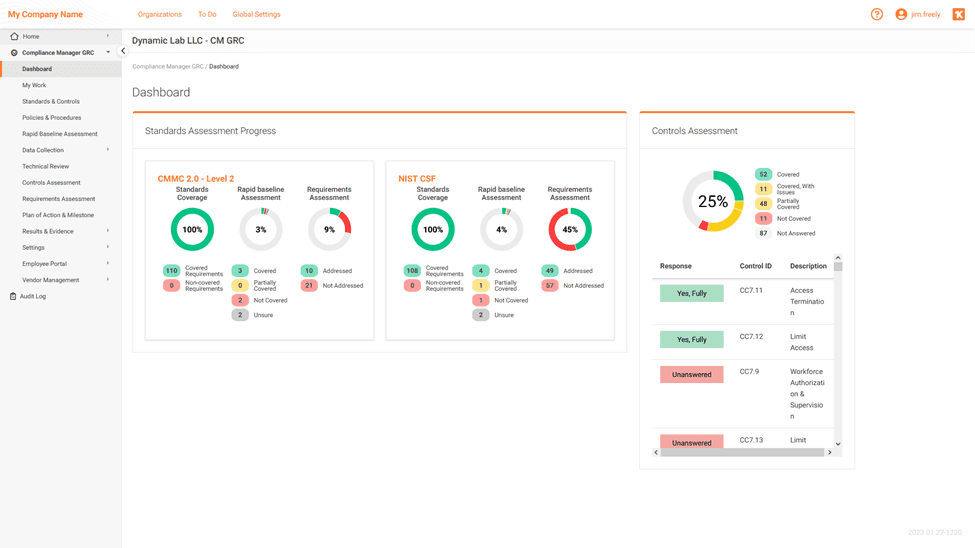

Compliance Manager GRC

Stay compliant with IT security requirements from any source, including government and industry standards, cyber insurance and your own IT policies.

Discover CMGRCYou Can’t Manage Risks You Don’t Know About

Without the right tools, it’s impossible to manage risks and ensure compliance with your IT requirements. Our IT tools make it easy to maintain complete visibility of your growing network, prioritize your security measures and document compliance with every IT security requirement thrown your way.

of IT devices are never reviewed for risk or compliance after initial setup.

new vulnerabilities are discovered every day.

organizations are unknowingly out of compliance with their own IT policies.

Know Your Network!

Rule number one in IT risk assessment and compliance is to know EVERYTHING that’s changing on the networks you manage. Network Detective Pro automates IT risk assessments and generates comprehensive management plans, so you can tell what’s changed that creates new risks, and prioritize your resources to tackle the most critical issues first.

Discover Hidden Vulnerabilities

With more than 50 new hidden vulnerabilities identified every day, it’s impossible to find them all. VulScan includes all the features you need to effectively harden your entire IT environment without all the complexity. We make it easy to perform both internal and external scans. You decide when to scan, how frequently to scan and which devices to scan.

Discover Insider Threats Before Hackers

More than 70% of all cybersecurity incidents today are the result of internal security issues that no firewall or antivirus tool can prevent. Cyber Hawk is a specialized IT risk assessment tool that identifies anomalous activity, suspicious changes and threats caused by misconfigurations, and generates the reports you need to take immediate action.

IT Audit & Compliance Management for All

IT professionals are NOT compliance experts, yet the organizations they manage expect them to keep them safe and in compliance at all times. Kaseya Compliance Management solutions put the expertise in IT pros’ laps by automating the management of dozens of compliance standards for them, allowing them to focus their real expertise where it matters most.

Featured Workflow Integrations for Audit & Compliance Solutions

Below are some of the most popular integrations in IT Complete for the Audit & Compliance Suite.

Network Detective Pro + Autotask

Discovered assets and user counts can drive billing out of Autotask.

Compliance Manager GRC + IT Glue

Evidence of compliance reports can be automatically pushed into IT Glue.

VulScan + RocketCyber

Risks and vulnerabilities discovered by VulScan can be automatically sent to the RocketCyber SOC.

Why IT Professionals love Kaseya's IT Complete

“We decided to go with Kaseya because it seemed to be the most complete solution. Other solutions we looked at, they’d have one part or the other, but with Kaseya we have it all”