Remotely Monitor, Manage & Secure Every Endpoint in Your Network

IT Complete’s RMM suite unifies endpoint management within a single tool and platform. Any device, any endpoint, any environment, any anything.

Explore Kaseya's Endpoint Management Solutions

With Kaseya’s IT complete platform, there are no wrong options. Choose between two of the most popular, secure and scalable RMM solutions on the market. Feel confident knowing you selected the solution to best fit your current and future needs.

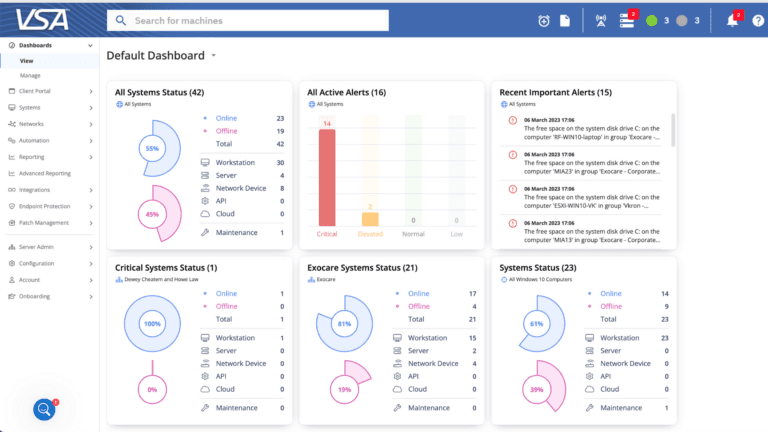

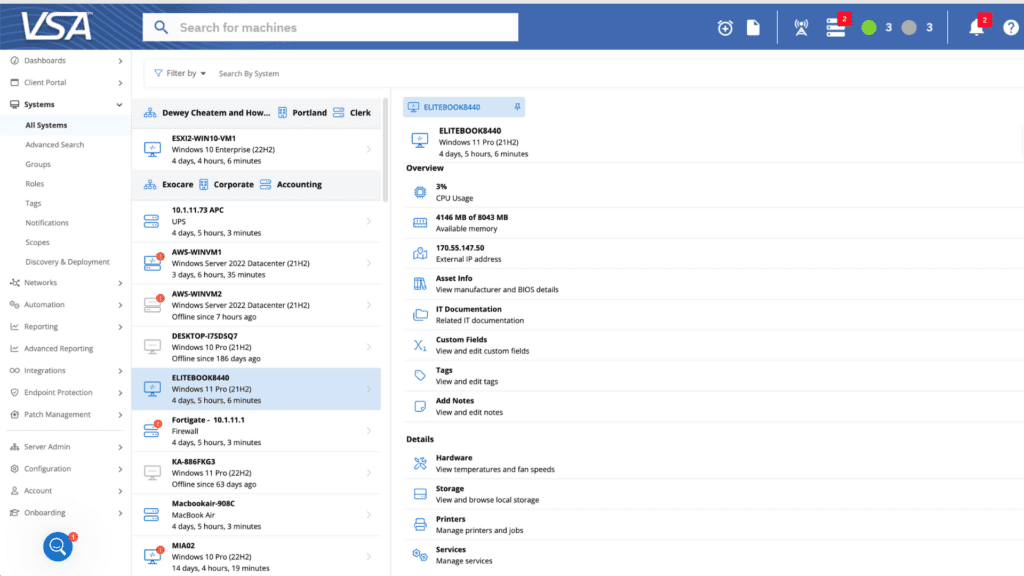

Kaseya VSA

Kaseya VSA supercharges IT teams with its all-in-one endpoint management, network monitoring, patching, remote control and truly easy automation.

Discover VSA

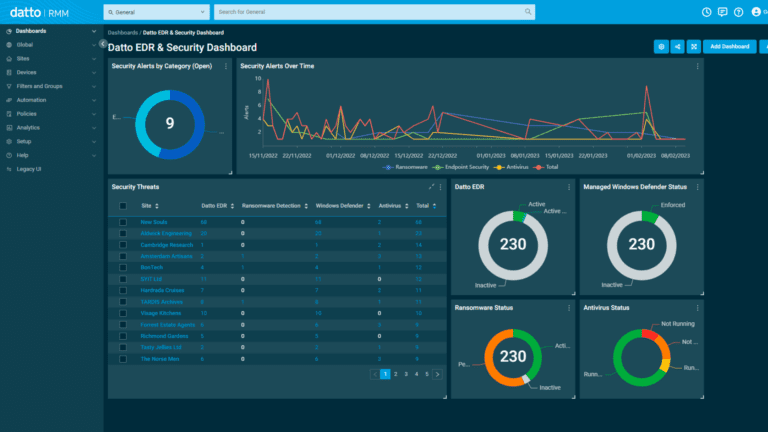

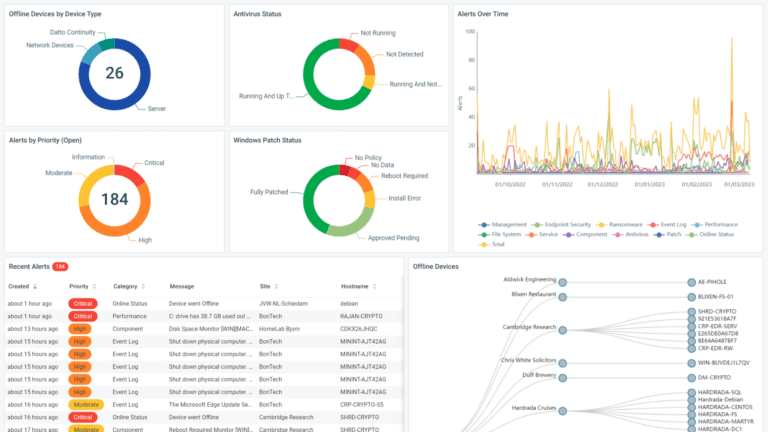

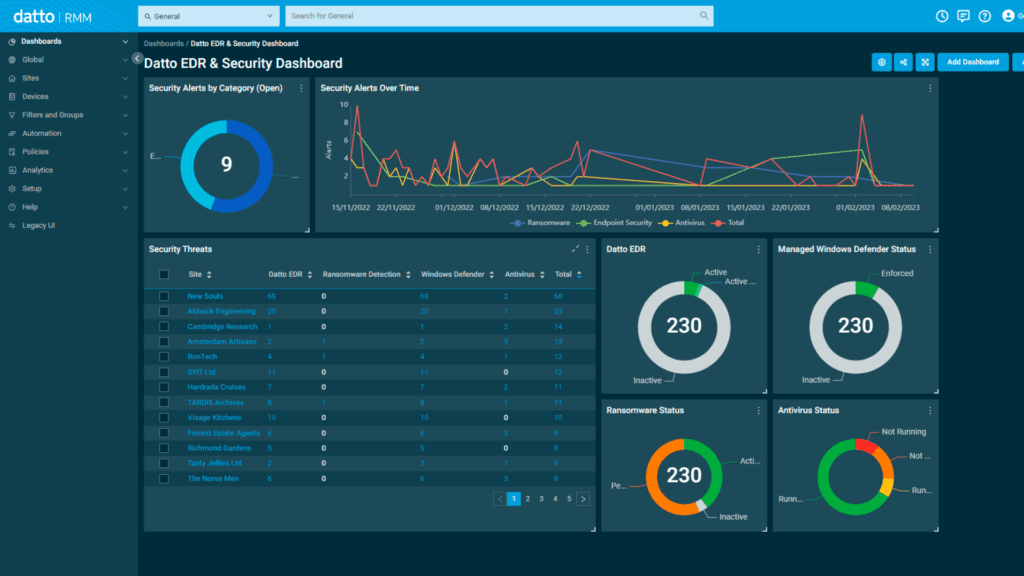

Datto RMM

Datto Remote Monitoring and Management (RMM) is a 100% cloud-based platform designed for easy, UI friendly management of any and all IT environments.

Discover Datto RMM

NOC Services

Kaseya and Datto's industry-leading Network Operations Center (NOC) allow you to outsource consistent delivery of daily IT responsibilities on your terms.

Discover NOC

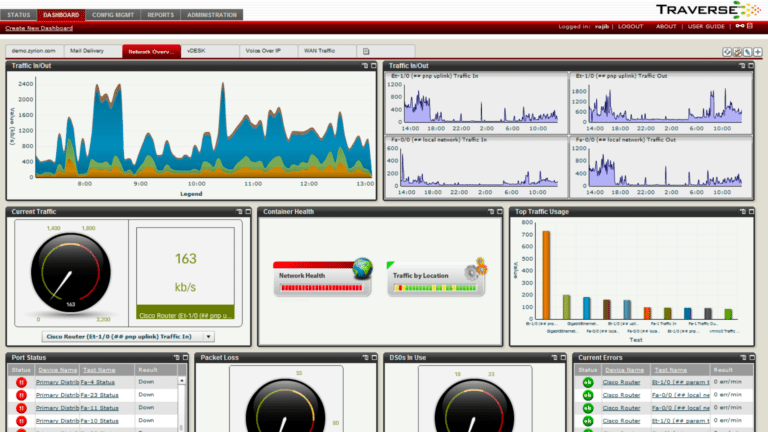

Traverse

Traverse monitors network performance in an action-oriented platform built for today's IT complexities, whether onsite, in the cloud or hybrid.

Discover Traverse

The Definition of 'Endpoint' has Evolved

Today’s “endpoint” has evolved to anything with a digital pulse, be that a PC or Mac, VDI, mobile device or IoT. Kaseya’s complete, powerful and automated endpoint management solutions manage all endpoints and stay two steps ahead of endpoint evolution. Say goodbye to burnout, software vulnerabilities and wasted time.

of IT Professionals report increased burnout.

of ransomware attacks are the result of unpatched software.

of a technician’s time is wasted swapping between disconnected tools.

Manage Any Endpoint, Anywhere

In a world where new devices and services arrive daily, a modern endpoint management solution must seamlessly manage and adapt to ever-changing environments anywhere, at any time. Both of the Kaseya RMM tools treat every device as first class to empower you with a future-proof platform to manage and unify IT.

Patch, Harden & Protect Every Endpoint

The Kaseya RMM solutions are designed with a relentless focus on security. Patch every endpoint automatically with best-in-class automation and the largest software catalog on the market. Leverage policy-based configuration hardening to keep bad actors at bay. Detect and quarantine ransomware before it becomes a problem. Enhance threat detection with integrated AV, AM, EDR and Managed SOC.

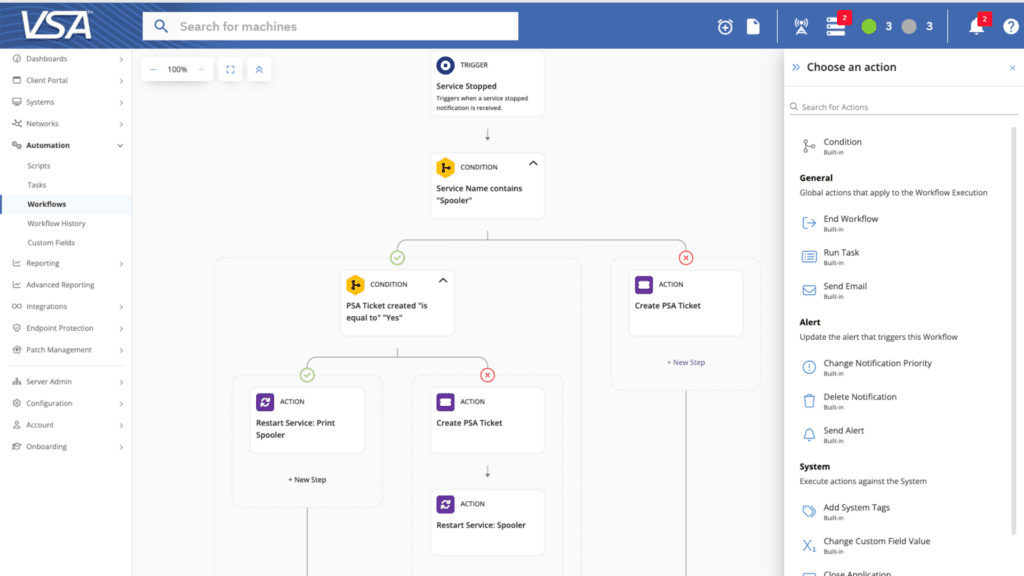

Make IT Easy With RMM Automation

If it’s worth doing, it’s worth doing right. The Kaseya RMM solutions leverage industry-defining automation to accelerate ticketing, network monitoring, patching, security and backup. Standardize best practices to guarantee excellent service delivery, improve efficiency, reduce delivery costs and free up time for higher-value work by automating more than you ever thought possible with Kaseya.

Featured Workflow Integrations for RMM Solutions

Kaseya’s deep workflow integrations to and from its RMM solutions allow IT professionals to keep IT documentation up to date, initiate a restore from backup, automate everyday tickets and more — all from within the RMM tool.

VSA & BMS

Optimize daily technician efficiency with 30% fewer tickets resolved 40% faster with ticket auto-remediation, remote control and asset synchronization.

VSA & IT Glue

Get IT Glue contextual information right in VSA. Access procedures, passwords and information related to assets or organizations in under three clicks.

VSA & Unitrends

Deploy the world’s best DRaaS and BCDR services, available in both an appliance-based and cloud-native platform, straight from VSA.

Datto RMM & Autotask

Troubleshoot and resolve issues faster by remote controlling an endpoint directly from a ticket, asset synchronization and auto-remediation of tickets.

Datto RMM & IT Glue

Access IT Glue data seamlessly in Datto RMM to improve efficiency, consistency and security, and inject passwords during remote control sessions.

Datto RMM & Datto BCDR

Directly open and manage the backup appliances from within Datto RMM to configure, back up, restore and manage alerts quickly and easily.

Why IT Professionals love Kaseya's IT Complete

“We decided to go with Kaseya because it seemed to be the most complete solution. Other solutions we looked at, they’d have one part or the other, but with Kaseya we have it all”