01. Introduction

With new and revolutionary technologies replacing old systems and tools, fresh opportunities will emerge for MSPs worldwide. MSPs who embrace these technologies quickly can stay ahead of the curve and gain a competitive advantage.

MSPs can reduce costs, increase efficiency and streamline processes with technologies like IT Process Automation and a fully integrated IT ecosystem. By automating tasks like patching, standard tickets and simple incident response and remediation, MSPs can address labor shortages, provide more responsive customer service and unlock new revenue channels, increasing customer satisfaction and loyalty. The integration of core tools will help MSPs streamline operations, reduce costs and make better decisions faster.

Whether we skirt a potential recession or dive deep into it, the most lucrative client base for MSPs — small and midsize businesses (SMBs) — will be turning to them to accelerate their digitalization efforts, streamline their operations and strengthen their cybersecurity efforts. To meet this demand, MSPs must step up their game and become more operationally and technologically advanced.

02. MSP Pricing: A Few Questions

In this comprehensive guide, we will review the key findings from our 2023 Global MSP Benchmark Survey Report, examine what affects the pricing of managed solutions and what MSPs can do to boost profitability in 2023 and beyond.

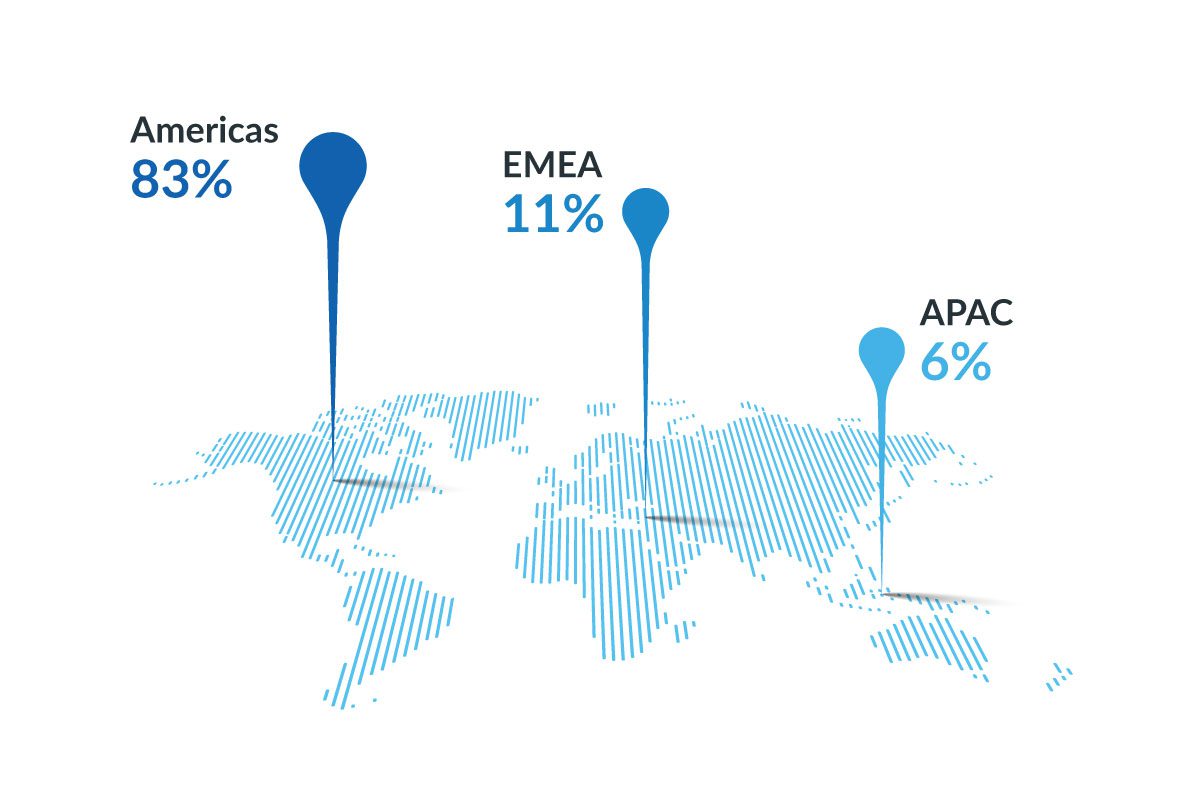

This year, the Kaseya MSP Benchmark Survey had 1,091 respondents. The largest slice, 83%, came from the Americas, about 11% from Europe, the Middle East and Africa (EMEA), and the remaining 6% from the Asia Pacific (APAC) region.

About 63% of respondents identified themselves as general-purpose MSPs. Another 19% identified themselves as network- and data-center-focused, primarily overseeing servers, storage devices and other network components that keep businesses up and running. Managed security service providers (MSSPs) increased year over year to 18% of the respondent base.

| MSP respondent's profile | 2023 | 2022 |

|---|---|---|

| MSP | 63% | 67% |

| Managed security service provider (MSSP) | 18% | 17% |

| Network and data center focused | 19% | 12% |

| Specialized by market vertical | - | 4% |

In this article, we will address many of the questions MSPs and their clients have about how to price managed services such as:

- How are MSPs paid?

- How do MSPs make money?

- How much does an average MSP charge?

- How profitable is the average MSP?

Let's dive in to get valuable insights into what makes an MSP profitable while still making it the top choice of customers in the market.

How are MSPs paid?

Pricing is a crucial aspect of an MSP's profitability and revenue, and as such it requires careful consideration. Furthermore, MSPs must consider the customer profile and demand patterns before deciding which pricing systems to use. A strong pricing model should be suited to your business's current needs and should also be capable of scaling and adapting to future demands.

MSPs have a choice of multiple pricing models they can implement to bill clients for their services. The pricing model of choice usually varies with industry focus and the region the MSP serves. That said, some of the most popular pricing models are:

- Per-device

- Per-user

- Combination of per-user and per-device

- Tiered bundles for managed services

- Value-based (fixed-fee subscription)

- A la carte

Learn more about MSP pricing models and see what respondents had to say.

The 2023 Global MSP Benchmark Survey results show billing models to be fairly evenly distributed among respondents, demonstrating that there is no one-size-fits-all model. According to the survey results, more than one-quarter of MSPs have implemented a combination of per-user and per-device pricing models. More than one-fifth have implemented a per-user pricing model to bill customers while 12% bill their customers based on an a la carte pricing model. The popularity of the per-device pricing model has waned — selected by only 13% of respondents as opposed to 17% in 2022.

How do MSPs make money?

MSPs typically earn revenue based on the services they provide to their customers — although how they charge for those services varies quite a bit. Cybersecurity holds great promise since even small businesses are becoming more aware of the risks associated with cyberattacks and are willing to invest in top-of-the-line cybersecurity solutions. Almost two-thirds of respondents said their services revenue for security increased in the 12 months prior to the survey as compared to the previous 12 months. Also, the top five services respondents intend to offer in 2023 fall under the cybersecurity umbrella.

Cloud management is another service through which MSPs are earning a major portion of their revenue. Infrastructure monitoring and management (including server support), desktop support, network and connectivity support, and business continuity and disaster recovery are also among the top six categories for which MSPs had their service revenue go up in the 12 months prior to the survey. Security operations center (SOC) services and compliance management are also gaining significant traction across the industry.

Other popular services MSPs earn revenue from include hardware/software resale, application management and mobile device management. Learn more about MSP revenue streams and see what respondents had to say.

How much does the average MSP charge?

MSPs use several pricing models to bill their clients. Two of the most common models are per-device and per-user. In these models, the MSP charges a fixed price for each device or user they manage while providing clients greater flexibility and cost savings.

According to our survey results, more than one-fourth (28%) of respondents that offer per-device pricing charge their customers between $50 and $100 per device, per month for ongoing support and maintenance. When it comes to per-user pricing, 22% of respondents charge their customers between $50 and $100 per user, per month for their services. Learn more about MSP rates and see what respondents had to say.

Are MSPs profitable?

Profitable growth is one of the fundamental goals of all MSPs. However, achieving it is not as straightforward as it may seem. Pricing your services both competitively and with scalable margins is imperative to ensuring you make (and grow) profits from the services you provide to your customers.

The quality of service delivery and pricing are crucial to an MSP's profitability and revenue. Being able to balance both simultaneously requires careful consideration. Flexibility and variety in pricing are the two key factors customers find most attractive in an MSP. Learn more about MSP margins and see what respondents had to say.

We will now discuss the key factors that impact MSP profitability and how you can adjust your pricing models, revenue streams, pricing considerations and margins to boost your bottom line. Read on to find out how top MSPs price their services to ensure sustainable growth and profitability in the long run with comprehensive statistics from our 2023 Global MSP Benchmark Survey Report.

03. MSP Pricing Models

Pricing plays a pivotal role in determining an MSP's revenue and profitability. To achieve sustainable growth and earn consistent profits, you must ensure that you bill your clients accurately for your services each and every month.

There are a host of pricing models that MSPs implement, depending on their unique business needs. In this section, we will walk through the different pricing models that MSPs use to bill their clients.

Per-device

The per-device model is a popular pricing model in which an MSP charges a fixed fee, often monthly, for each device it supports. This pricing model provides MSPs with tremendous flexibility and is simple for clients to understand. The flat fee varies with the type of device being supported.

On the flip side, this billing structure can become more complicated as clients continue to add more devices, such as smartphones and tablets, to their network or when clients embrace a bring-your-own-device (BYOD) IT infrastructure at their workplace.

Per-user

Under the per-user pricing model, MSPs typically charge their clients a flat fee for each user they support on a monthly basis. This pricing model is particularly beneficial for MSPs with clients that need every end user to stay connected with a set number of devices.

This is an easy-to-understand and flexible pricing model. Additionally, it's easier for clients to modify an agreement based on the growth and evolution of their business. One drawback of this model, however, is that MSPs risk a fluctuating revenue stream dependent on their client's employee base and hiring plans as well as device additions that may increase costs without added revenue.

Tiered (aka bundle)

One of the more popular pricing models among MSPs, the tiered model involves building several bundled service packages. The tiers rise from basic to premium, and each bundle is available at a different price point based on the number and type of services, features and support level. This allows MSPs to offer different service levels to customers with different budgets and needs.

Under the tiered model, businesses enjoy the flexibility to upgrade or downgrade their chosen bundle according to their evolving needs and budget patterns. For MSPs, tiered pricing that offers multiple levels of support can be difficult to manage as opposed to a unified streamlined service offering.

Value-based

Also termed as “cake” pricing, the value-based pricing model is a flat-fee model wherein an MSP provides all its services at a single fixed rate. Essentially, an MSP acts as the extension of its client's IT department and takes care of the latter's IT environment.

Value-based pricing is one of the easiest models for busy MSPs to implement. It allows them to adjust their prices to the value they provide, clients and service levels, rather than basing them on their costs or the market. This allows MSPs to make more money while providing better services to their customers. However, this pricing model can confuse clients since they never get to know the individual price of each service provided. It also risks escalating the MSP’s costs when unforeseen issues arise.

A la carte

Under the a la carte pricing model, an MSP offers specific services that address clients’ specific needs. These services include patch management, managed backup and disaster recovery. Under this model, clients have the freedom to create a customized package for their business by picking out the services they need.

Current MSP Pricing Model Trends

According to our survey findings, a majority of the MSP respondents implement a combination of per-user and per-device pricing models. Under this combination model, customers get tremendous flexibility and the “best of both worlds” that attracts them to MSPs that offer it. In this survey edition, we also saw the value-based (fixed fee subscription) managed services model gain favor over the per-device model. The value-based model offers businesses more control over their IT budgets while ensuring they get the services they need. It also helps MSPs gain a steady cadence of monthly recurring revenue (MRR), making it a win-win situation.

| Predominant billing model for MSPs | Respondents |

|---|---|

| Combination of per-user and per-device | 26% |

| Per user (all-in seat price) | 21% |

| Value-based (fixed fee subscription) managed services | 14% |

| Per-device | 13% |

| A la carte | 12% |

| Tiered bundles for managed services (e.g., Gold, Silver and Bronze) | 10% |

| Incident response | 3% |

| Other (please specify) | 2% |

A la carte and tiered bundles for managed services are also an attractive billing model for customers that want greater flexibility to choose a custom bouquet of services at a predefined rate. This model provides customers with the flexibility to upgrade or downgrade their chosen bundle based on evolving business needs.

04. MSP Revenue Streams

As mentioned, MSPs depend on revenue earned from their services. With the pandemic well behind us, SMBs face a tough economic environment, and they will need support from MSPs to accelerate their digitalization efforts and streamline their IT infrastructure. Increasing cyberattacks pose another challenge, and incidents are only likely to increase in a volatile economy. Against this backdrop, MSPs should be ready to offer a suite of services tailored to meet the specific needs of their customers. With the right approach, MSPs and their clients can emerge stronger than ever.

We asked the respondents to share whether their revenue in a particular service category went up, down or stayed flat in 2022. This is what they said:

| Service categories | Up | Flat | Down | Not Applicable |

|---|---|---|---|---|

| Security | 65% | 25% | 4% | 6% |

| Cloud management | 48% | 36% | 4% | 12% |

| Business continuity and disaster recovery | 47% | 38% | 5% | 10% |

| Infrastructure monitoring and management (including server support) | 45% | 40% | 7% | 8% |

| Desktop support | 42% | 44% | 8% | 6% |

| Network and connectivity support | 39% | 49% | 6% | 6% |

| SOC services | 36% | 33% | 4% | 27% |

| Compliance management | 35% | 36% | 4% | 25% |

| Hardware/software resale | 33% | 40% | 15% | 12% |

| Application management | 32% | 42% | 5% | 21% |

| Mobile device management | 28% | 43% | 7% | 22% |

Security Services

Security is the top-performing service category for MSPs, with nearly two-thirds of respondents recording a significant upward trend in service revenue over the prior year. This is not surprising since there has been a significant increase in the number of ransomware and other malicious cyberattacks over the past couple of years. As such, companies have become more vigilant about their cybersecurity posture and are seeking the most advanced security services to protect their sensitive data and networks. SMBs are increasingly turning to their MSP partners for assistance to enhance their security setup and ensure compliance with relevant regulations. Therefore, security continues to reign supreme as the frontrunner among the most high-in-demand managed services. This provides a growth opportunity for MSPs that offer these services and is a deficit for those that do not.

Cloud Management

With most businesses leveraging the power of the cloud, MSPs have a tremendous opportunity to provide cloud management services to their clients. Cloud management includes monitoring and managing the client's cloud infrastructure by providing managed services such as computing, cloud security, network operations and storage. Almost half the MSPs surveyed (48%) said that their service revenue for cloud management has gone up over the prior 12 months.

Business Continuity and Disaster Recovery (BCDR)

In conjunction with backup services, business continuity and disaster recovery (BCDR) helps businesses minimize the impact of an unforeseen security event and ensures they can get back up on their feet quickly after a service disruption. Since cyberattacks are on the rise, respondents (47%) placed BCDR third on a list of 10 services in which revenue increased year over year. BCDR ranked sixth in revenue growth in 2022.

Infrastructure Monitoring and Management

Infrastructure monitoring and management is another mission-critical managed service MSPs offer to their customers. This service includes the collection and analysis of data from a client's IT infrastructure, processes and systems, and utilizing it to enhance business outcomes and propel value across the organization. About 45% of the respondents said that their service revenue for infrastructure monitoring and management went up over the prior year.

Desktop Support

MSPs offer desktop support to their customers to help them resolve any issues end users might be facing with their workstations. The category reflected slowing growth as revenue rose for about 42% of MSP respondents while it remained flat for 44% of respondents. This slowing growth could be attributed to most companies asking employees to return to the office and already having well-oiled hybrid infrastructures and protocols in place.

Network and Connectivity Support

As the name suggests, network and connectivity support represent services that focus on the maintenance of a business network. Under this category, MSPs provide their clients with services like remote monitoring, troubleshooting, diagnostics, network connectivity, operating system upgrades, scheduling antivirus updates and application patches. For 39% of MSP respondents, service revenue for network and connectivity support increased over the prior 12 months.

SOC services

A SOC is an in-house or third-party facility that houses an information security team responsible for continuously monitoring, detecting, analyzing and responding to cybersecurity incidents 24/7/365. Essentially, SOC analysts detect cybercrime, build defenses against it and then eliminate it if one occurs. For SMBs, outsourcing their security needs to a SOC is more efficient and cost-effective than building and managing a security team in-house. More than one-third (36%) of MSP respondents reported an increase in revenue from SOC services, which is a testament to the value of SOC services.

Compliance Management

Regardless of the industry, businesses must comply with an increasing amount of regulatory standards to prevent security issues and avoid non-compliance and consequent hefty penalties. MSPs help customers stay on top of compliance requirements, such as HIPAA, PCI DSS, CCPA and GDPR, with compliance management services. The service holds promise for MSPs that want to open new revenue streams and increase their revenue since about 35% of MSPs recorded an increase in service revenue for compliance management over the prior 12 months. Moreover, in this survey edition, fewer respondents reported flat revenue in this service category.

Hardware/software resale

MSPs can generate a steady stream of income by reselling hardware, such as computers, servers and networking equipment, and software such as operating systems, productivity suites and security solutions to their clients and pocketing the reseller margin. One-third (33%) of MSPs said they reported an increase in revenue in this service category.

Application Management

MSPs offer application management services through which they help maintain and manage custom or third-party software applications for their clients. This includes migrating or managing data, designing or building applications, reporting and analytics, content management, testing, and general maintenance and enhancements. According to our survey report, 32% of MSPs recorded an increase in revenue for application management between 2021 and 2022.

Mobile Device Management (MDM)

Mobile device management (MDM) is the process by which MSPs help their customers boost corporate data security by monitoring, securing and managing the mobile devices (e.g., smartphones, tablets and laptops) on the latter's business infrastructure. MDM solutions enable MSPs to configure a company's security policies on mobile devices that are used to access sensitive corporate data in the organization. Given the increased use of mobile devices for corporate purposes, 28% of MSPs said that their service revenue in this category went up over the prior year. The proportion of MSPs who have seen revenue growth in this category has consistently increased year over year for four straight years.

Current MSP Revenue Trends

Cybersecurity and ransomware news have made headlines over the past few years, causing organizations of all sizes to realize that having a robust security setup is non-negotiable. Furthermore, it's not uncommon for the overall cost of recovering from a ransomware attack to exceed the ransom, reputation damage notwithstanding. To avoid landing in cybersecurity hot water, businesses are opting for full stack security services, which has made security (65%) the top and BCDR (47%) among the top three service categories for which most of the MSPs have recorded an increase in revenue over the prior 12 months.

In line with the cybersecurity theme, SOC services and compliance services are also on an upswing as more businesses direct their security needs to third-party vendors to get better security and compliance while freeing themselves to drive growth in the core business.

Cloud management has emerged as another top performer in terms of service revenue growth, with 48% of MSPs saying that they recorded an increase in revenue for this category as organizations shift away from traditional on-premise solutions to reduce costs associated with hardware and maintenance, and achieve efficiency and speed.

One of the few categories where MSPs recorded a downward trend was in hardware and software resale, which could point toward the shift to cloud-based solutions that let customers access their applications and services on demand and at a lower cost.

Let's look at the most high-in-demand managed services that presented tremendous growth opportunities for MSPs in 2022.

| Most Requested Services | Respondents |

|---|---|

| Cloud Migration | 22% |

| Email Security | 15% |

| Business Continuity | 14% |

| Security Awareness Training and Phishing Testing | 11% |

| Remote Workforce Setup | 9% |

| Password Manager and Identity Access Management | 8% |

| Digital Transformation | 6% |

| Communications setup | 5% |

| SOC Services | 5% |

| Dark Web Monitoring | 3% |

The pandemic drove SMBs to swiftly upgrade their IT infrastructure, embracing cloud-based and digital tools to stay competitive and serve clients remotely. Cloud services are a boon for the fast-expanding midmarket segment which can pay on the go and expand and scale their business without incurring high IT infrastructure costs, which makes it the top requested service.

Customer requests speak volumes about their concerns. When asked to select the technology or services that customers most requested in the past year, the demand for almost all the services under the cybersecurity umbrella saw a uniform increase.

Given that security continues to be a major concern, it's not surprising email security has emerged as the most important security service businesses requested from MSPs to combat phishing. Now, more than ever, businesses want to ensure that their employees are aware of their security policies and know how to deal with security hazards. As such, security awareness training and phishing testing is a highly requested service that MSPs should make sure to offer in their solution stack.

05. MSP Rates

MSPs typically bill their customers based on the pricing model they have implemented. As mentioned previously, there are an array of pricing models that MSPs adopt based on their unique business requirements and business goals. Let's discuss some of the different MSP rates:

Per-user Rates

Under this pricing model, MSPs charge a flat fee per user, per month, for ongoing support and maintenance of all devices used by each user. This includes support for office PC, home PC and mobile devices, such as smartphones and laptops.

Per-device Rates

MSPs charging per-device rates charge a flat fee per device, per month, for ongoing support and maintenance. The price of each device varies based on the complexity involved in managing it. For instance, an MSP might charge more per device for managing a server than a desktop.

Per-hour Rates

Under this model, MSPs charge customers on an hourly basis, depending on the services provided.

Per-month Rates

As the name suggests, under this model, MSPs charge their customers on a monthly basis, depending on the services provided.

Current MSP Rate Trends

Under the per-device pricing model, more than a quarter (28%) of the respondents charge $50 - $100/device/month for ongoing support and maintenance.

| Per-device pricing model | Respondents |

|---|---|

| Less than $50/device/month | 20% |

| $50–$100/device/month | 28% |

| $101–$150/device/month | 11% |

| $151–$200/device/month | 5% |

| $201–$250/device/month | 3% |

| More than $250/device/month | 2% |

| We do not offer per-device pricing | 30% |

Nearly a quarter (22%) of respondents charge $50 to $100 per user per month for ongoing IT support (e.g., help desk and end-user device management).

| Per-user pricing model | Respondents |

|---|---|

| Less than $50/device/month | 16% |

| $50–$100/user/month | 22% |

| $101– $150/user/month | 17% |

| $151–$200/user/month | 11% |

| $201–$250/user/month | 4% |

| More than $250/user/month | 1% |

| We do not offer per-user pricing | 28% |

06. MSP Margins

The percentage of respondents who reported an average MRR range of $7,501 to $10,000 doubled to 4% from 2% in 2022.

| Average size of monthly managed service contract per client | 2023 | 2022 |

|---|---|---|

| Up to $1,000 | 22% | 19% |

| $1,001–$2,500 | 26% | 28% |

| $2,501–$5,000 | 23% | 24% |

| $5,001–$7,500 | 11% | 9% |

| $7,501–$10,000 | 4% | 2% |

| More than $10,000 | 4% | 4% |

| Not applicable | 10% | 14% |

About 7% of respondents reported declining MRR — nearly doubling from the 2022 Benchmark Report. The percentage of respondents reporting MRR growth under 15% increased slightly. Respondents who selected MRR options over 20% have remained at 15% from last year.

| Average MRR growth over the past 3 years | 2023 | 2022 | 2021 |

|---|---|---|---|

| Declining MRR | 7% | 4% | 6% |

| 0%–5% | 18% | 17% | 17% |

| 6%–10% | 26% | 31% | 28% |

| 11%– 15% | 21% | 20% | 20% |

| 16%–20% | 12% | 13% | 13% |

| More than 20% | 15% | 15% | 16% |

Cloud migration continued to be the most requested service by clients in 2022. Respondents also anticipate that managing public cloud adoption/migration/support (IaaS, PaaS, SaaS) will be the third biggest IT challenge for clients in 2023. It signals growing cloud usage and gross margin improvement across brackets.

| Gross margin range for cloud services | 2023 | 2022 |

|---|---|---|

| Less than 5% | 6% | 5% |

| 6%–10% | 14% | 13% |

| 11%–20% | 23% | 29% |

| 21%–30% | 20% | 21% |

| 31%–40% | 13% | 9% |

| 41%–50% | 9% | 6% |

| More than 50% | 6% | 7% |

| We do not offer cloud services at this time | 8% | 9% |

07. Price for profitability and increase revenue with Kaseya

When it comes to MSP profitability, pricing plays a critical role. Pricing your services right and charging your clients appropriately can help you not only stay competitive in the market but also boost your profits and drive growth.

Kaseya's revolutionary solutions help MSPs cater to the evolving service needs of their customers to stay relevant. With Kaseya's solutions, you not only simplify, streamline and secure your clients' IT environments, but also gain a competitive edge over your peers and expand your customer base.

Discover how much you can save in money and time by deploying a Kaseya solution with our ROI calculator.

For a more in-depth understanding of today's MSP landscape and the latest trends for profitability growth, download the 2023 MSP Global Benchmark Survey Report.